Courses

NTU-FSFA Series FinTech Courses

FinTech is one of the fastest-growing sectors of the modern

economy, not just in Singapore but globally.

It is

recognized as a major factor in the Fourth Industrial

Revolution. FinTech is a combination of the wordsFinancial

and Technology. It involves the innovative use of design and

delivery of financial services andproducts. Keep pace with

the latest financial technology and stay relevant in the

current digital and global age.

- 30-day training opportunity at Bandung Institute of Technology (ITB)

- SkillsFuture Funded Courses

- You do not need a Technical background

- The registration deadline is three weeks before the course starts

FinTech & Innovation

Fintech is the new trend in the financial sector. Fintech is reshaping howfinancial institutions are improving customer experience and developing newbusiness models. Integrating design principles together with emergingtechnologies and new business models can help you engage yourmanagement team to develop greater value propositions and stay relevant.

Enterprise Blockchain

Blockchain has gone from the esoteric underpinning of Bitcoin to a hyped-uptechnology that businesses in every sector believe could have atransformational effect. Many enterprises are now heavily investing inblockchain applications. This course covers the technologicalimplementation of blockchain and customized enterprise resource planning-based solutions.

Payments, Digital Currencies and

Cashless Economies

Digital Currencies exist before the age of Cryptocurrencies. It exhibitsproperties like digital currencies where it can be traded and used to purchasephysical goods and services. Despite its controversial position as aninstrument of trade, there exist applications where digital currencies can help.

Cloud & API Economy

The API economy is the exposure of an organization’s digital services andassets through application programming interfaces (API) in a controlled way.APIs ensure that the data extracted from one software application isformatted and passed to the next application without change. By exposingthe interfaces that allow microservices to communicate with each other,vendors are able to meet the needs of specific groups of customers withouthaving to redesign the organization's software

IoT

The “Internet of Everything” is the next big and imminent thing as businessesstart to collect data from device ranging from mobile phones to customdevices. The independent communication between different connecteddevices can be used to optimize operations, reduce costs, boost productivityand more importantly, promote financial inclusion among developing countries.Within a few years, the usage of devices increased from millions to billions andthe amount of time spent on these devices has been steadily rising.

Artificial Intelligence &

Machine Learning

Artificial Intelligence (AI) can create disruption to many traditionalbusinesses and industry sectors. Machine Learning (ML) can furtherenhance the capability of the bots by learning the preferences and behaviorsof the customers that they are serving. Participants will learn the basics of AIand ML as well as how chatbots and AI can work together.

Big

Data and Data Analytics

Big Data is already known as one of the pillars of technology in this modernday and age. However, its application, combined with machine learning, hasexponentially changed the way the various industries uses data. Data analyticsis the key to unlock new ways of having a competitive edge in an effort tomanage the date transformation journey.

FSFA Expert Advisory Team

James Dubois

Paris, France

Paris, France

Former fund manager of AXA IM, a large European fund Expertise: bonds and sustainable investment, ESG asset screening Member of the French National Financial Certification Association (AMF certification)

Anindya Kusuma

Jakarta, Indonesia

Jakarta, Indonesia

Former senior trader at Mandiri Securities, now an independent asset consultant Expertise: ASEAN stock investment, market volatility management Master of Finance from the University of Indonesia, WPPE and WMI qualifications

Marcus Tan

Singapore

Singapore

Former asset allocation strategist at GIC Government Investment Corporation Expertise: pension investment strategy, multi-asset portfolio allocation Master of Economics, University of Cambridge

Dr. Kelvin Lim

Singapore

Singapore

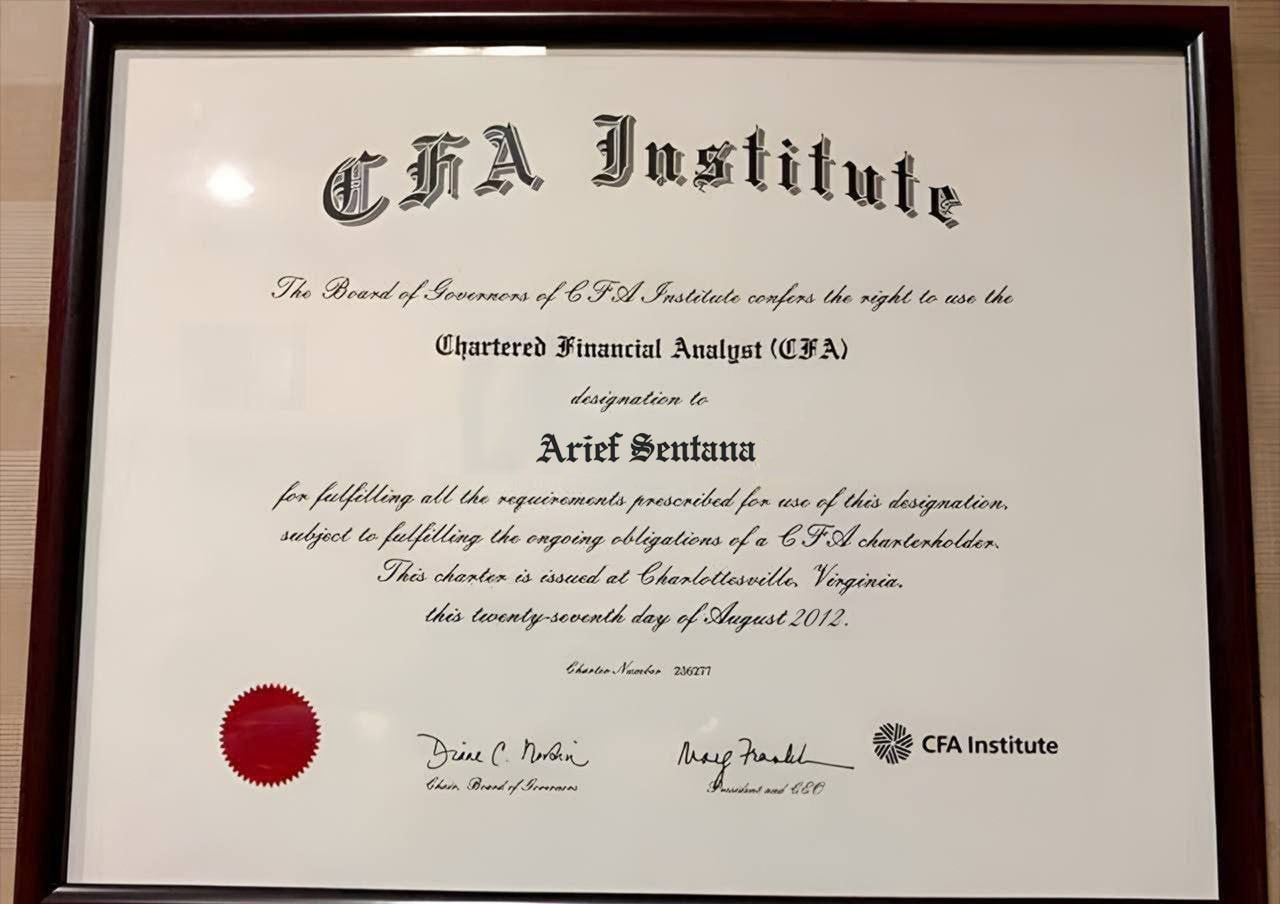

Associate Professor at the National University of Singapore, specializing in behavioral finance and investment psychology Former investment strategy consultant for the Education Fund under Temasek Holdings CFA, FRM certificate holder, published many books on Southeast Asian investment

Elena Novak

Frankfurt, Germany

Frankfurt, Germany

Senior consultant of Commerzbank, risk management expert Expertise: financial derivatives, structured product training Former member of the European Banking Authority's compliance advisory group

Nurul Hafsah

Malaysian

Malaysian

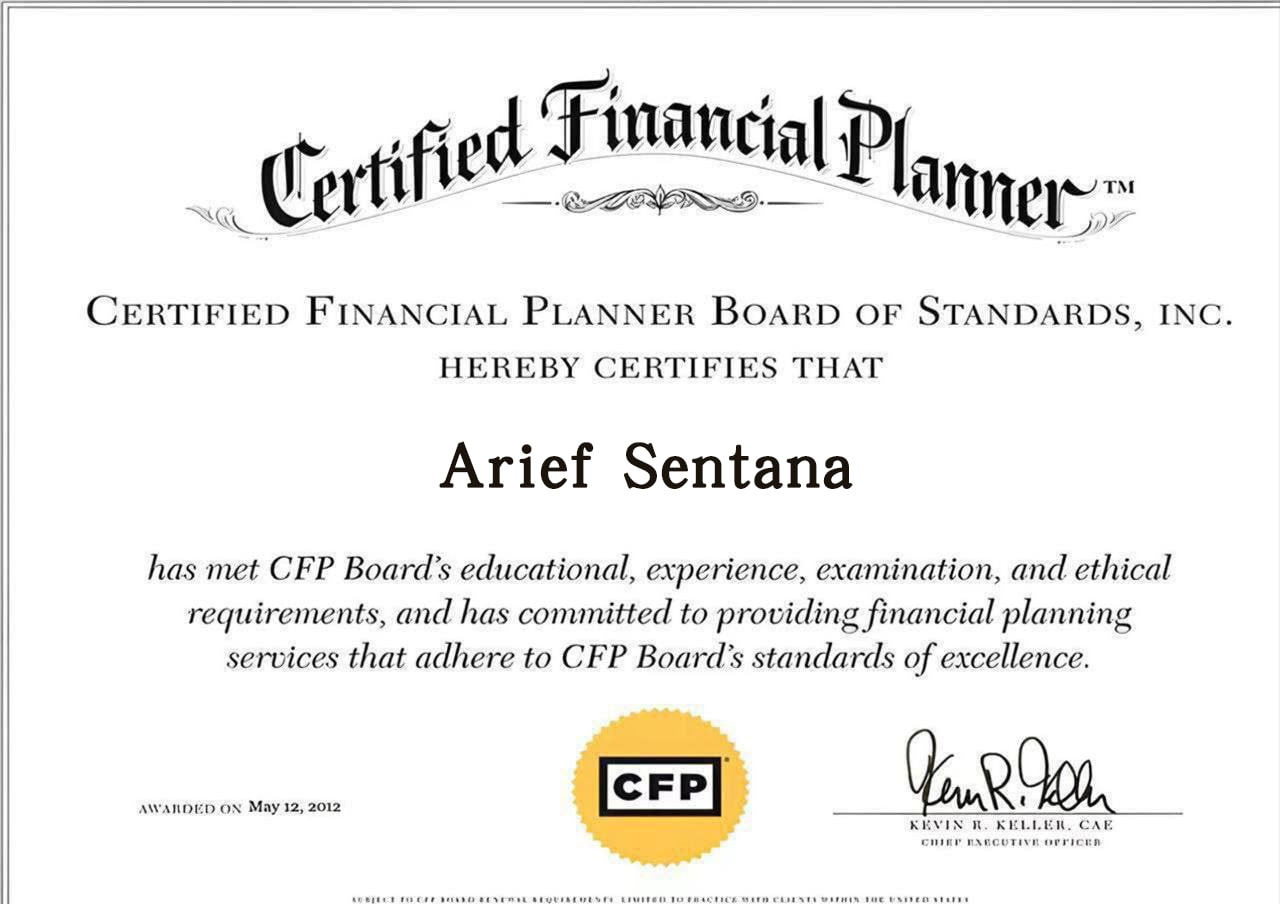

Former wealth advisor for HSBC Private Bank in Southeast Asia Expertise: Muslim finance, tax planning and wealth inheritance Master of Islamic Finance from the University of Malaya, CFP qualification